NASHVILLE, Tenn. (WTVF) — When Gary Hoffman opened a letter from the Property Assessor’s Office, he learned his home value had jumped 80%. That meant a major increase in his property taxes — and major stress.

“It’s been super stressful trying to gather everything for an appeal,” Hoffman said. “I understand values going up, but not by this much. It hits me right in the wallet.”

Hoffman isn’t alone. Thousands of Davidson County homeowners saw higher values after the latest mass appraisal. The assessor’s office says values are based on home sales in each neighborhood.

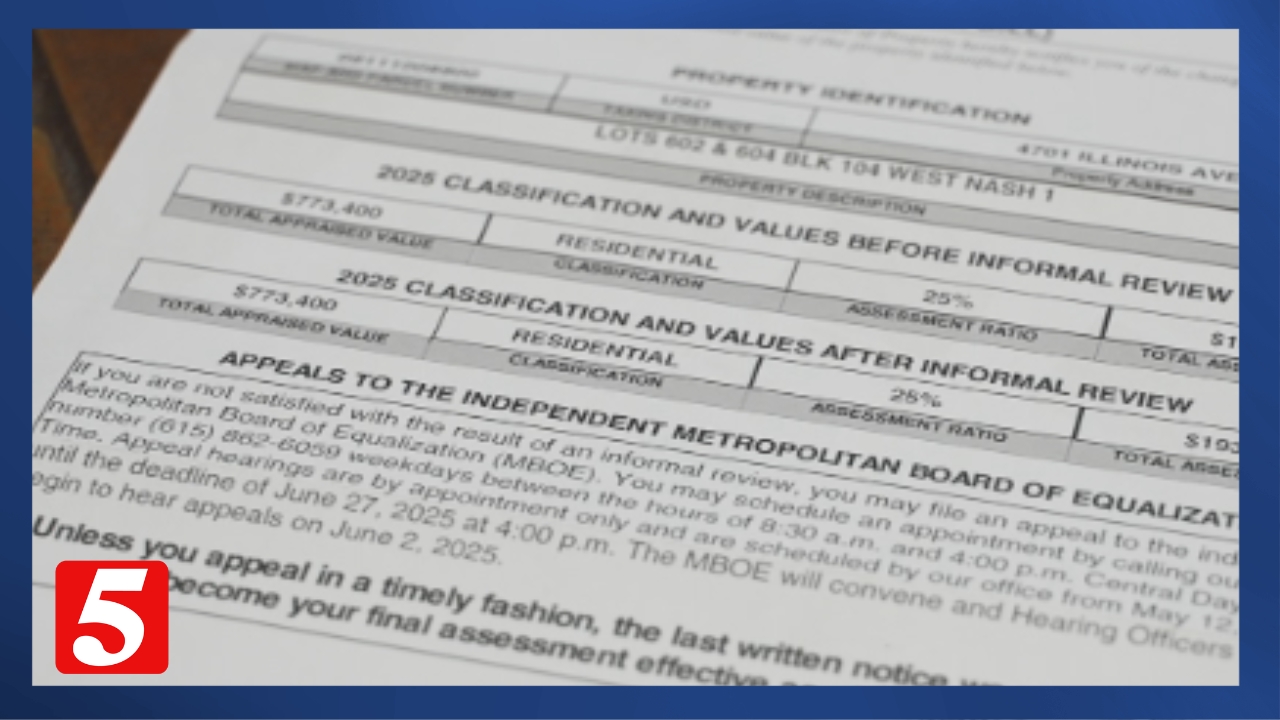

Out of 281,000 parcels, about 15,000 owners (5.4%) formally appealed their new values. The Assessor, Vivian Wilhoite, said her office did extensive outreach to explain the process.

Not just appraisals — tax rates matter

Wilhoite said it’s misleading to blame higher tax bills on appraisals alone. The mayor and Metro Council also voted to raise tax rates, and that increase plays a major role in many bills going up.

She provided examples:

Example 1: Value increased below the county median

This homeowner should have paid less with the certified tax rate — but because the tax rate increased, they’re paying $849 more instead.

Example 2: Value increased above the county median

A Trail Hollow Road property increased from $312,000 to $490,900 (57%).

– With the certified rate, taxes would have risen by about $168.

– With the tax rate increase, the 2025 bill jumped by $965 instead.

Wilhoite stressed that her office only sets values; elected officials decide tax rates.

Why the appeals process takes so long

More than 15,000 appeals were filed, but the independent Metro Board of Equalization (MBOE) has no dedicated staff. Hearings are scheduled in 15–20 minute slots, Monday–Thursday, but securing a quorum is often difficult because board members are volunteers with jobs and families.

Many appeals are also filed before property owners or attorneys review the facts — meaning some hearings clog the calendar even though they’re later withdrawn.

What homeowners should know

- If you think your home was overvalued, you can appeal.

- Deadlines matter: Appeals typically open in January and close in June.

- Even if you appeal, you still must pay the undisputed portion of your bill by Feb. 28 to avoid interest.

- Due to the unprecedented number of Appeals (15,249) filed to be heard by the independent Metro Board of Equalization, there remains 7,270 Formal Appeals Hearings that have been scheduled from now into November 2026.

Are you confused about why your property tax bill increased? Get the facts about appraisals versus tax rate increases and share your story by emailing kim.rafferty@NewsChannel5.com.

In this article, we used artificial intelligence to help us convert a video news report originally written by Kim Rafferty. When using this tool, both Kim and the NewsChannel 5 editorial team verified all the facts in the article to make sure it is fair and accurate before we published it. We care about your trust in us and where you get your news, and using this tool allows us to convert our news coverage into different formats so we can quickly reach you where you like to consume information. It also lets our journalists spend more time looking into your story ideas, listening to you and digging into the stories that matter.