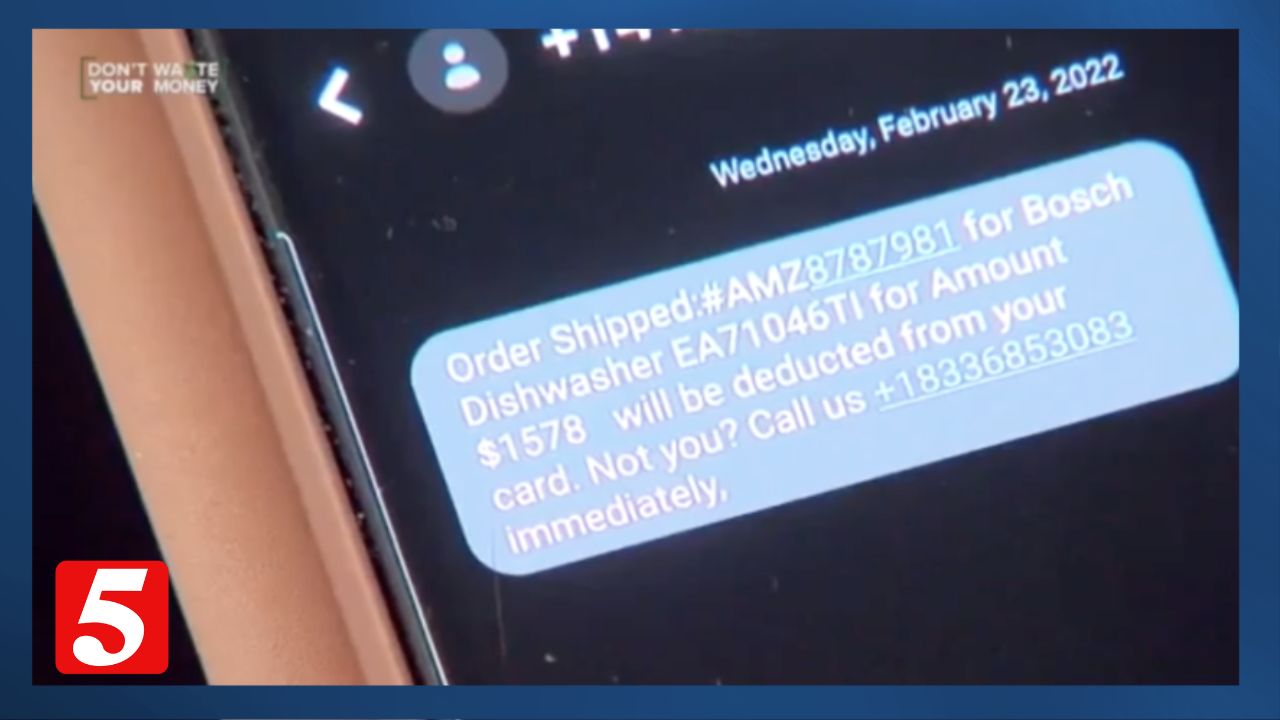

NASHVILLE, Tenn. (WTVF) — Whether it’s text that looks like it’s from your bank or a bogus bill from a toll road, if you think you’re getting more unsolicited texts and messages, you’re right.

The new Consumer Reports Cyber Readiness Report finds text scam attempts are up by 50%.

And this might surprise you: They’re growing the fastest among Gen Z’ers.

18 to 29-year-olds are getting scammed at record levels, and reports of text scam attempts from Gen Z’ers tripled.

“And it makes sense," said Consumer Reports' Yael Grauer. "They text a lot. It’s a primary form of communication. And they have instant access to money on their phones.”

Lower income households were three times as likely to lose money from scams. And the racial divide is striking too — 37 percent of Black Americans who ran into a scam lost money, compared to just 15 percent of white Americans.

According to the Federal Reserve, a larger share of white adults use credit cards compared to Black adults.

“Credit cards are safer than many other payment methods because you have the right to request a chargeback for fraudulent transactions," said Consumer Reports' Chuck Bell. "Consumers who do not use credit cards have fewer rights to dispute fraud when it occurs.”

How can you protect your money?

First, don’t reply to random or unsolicited texts. Responding confirms your number is active. So fraudsters might keep bugging you or sell your number. Instead, block the number and mark it as spam.

Next, cut down on text spam before it reaches you. Check with your phone carrier — most offer free tools to filter or block unwanted messages.

Also, watch out for phishing scams. Be suspicious of requests for personal information from texts, emails or messaging apps. If the message seems urgent or time-sensitive, that’s another red flag.

Finally, when shopping online, use a credit card. Payment Apps like CashApp, Venmo, and Zelle usually don’t offer the same purchase protections.

One additional piece of protection: Use a password manager. That way, you have a strong, unique password for each account.

Do you have more information about this story? You can email me at jennifer.kraus@newschannel5.com.

The aftermath of the historic ice storm will be felt for a long time by many, but what looked like a hopeless situation for one small business owner proved to be quite the opposite. This community would not let her fail. Patsy Montesinos shares the story with a truly happy ending.

- Carrie Sharp