NASHVILLE, Tenn. (WTVF) — Many Middle Tennessee residents are returning to warm homes after the recent ice storm. Still, others are dealing with significant damage and starting the insurance claims process. Understanding what's covered and what isn't can save you money and frustration.

Contact your insurance company first

The first step is contacting your insurance company to understand what's typically covered and what isn't, as homeowners' insurance policies can vary significantly.

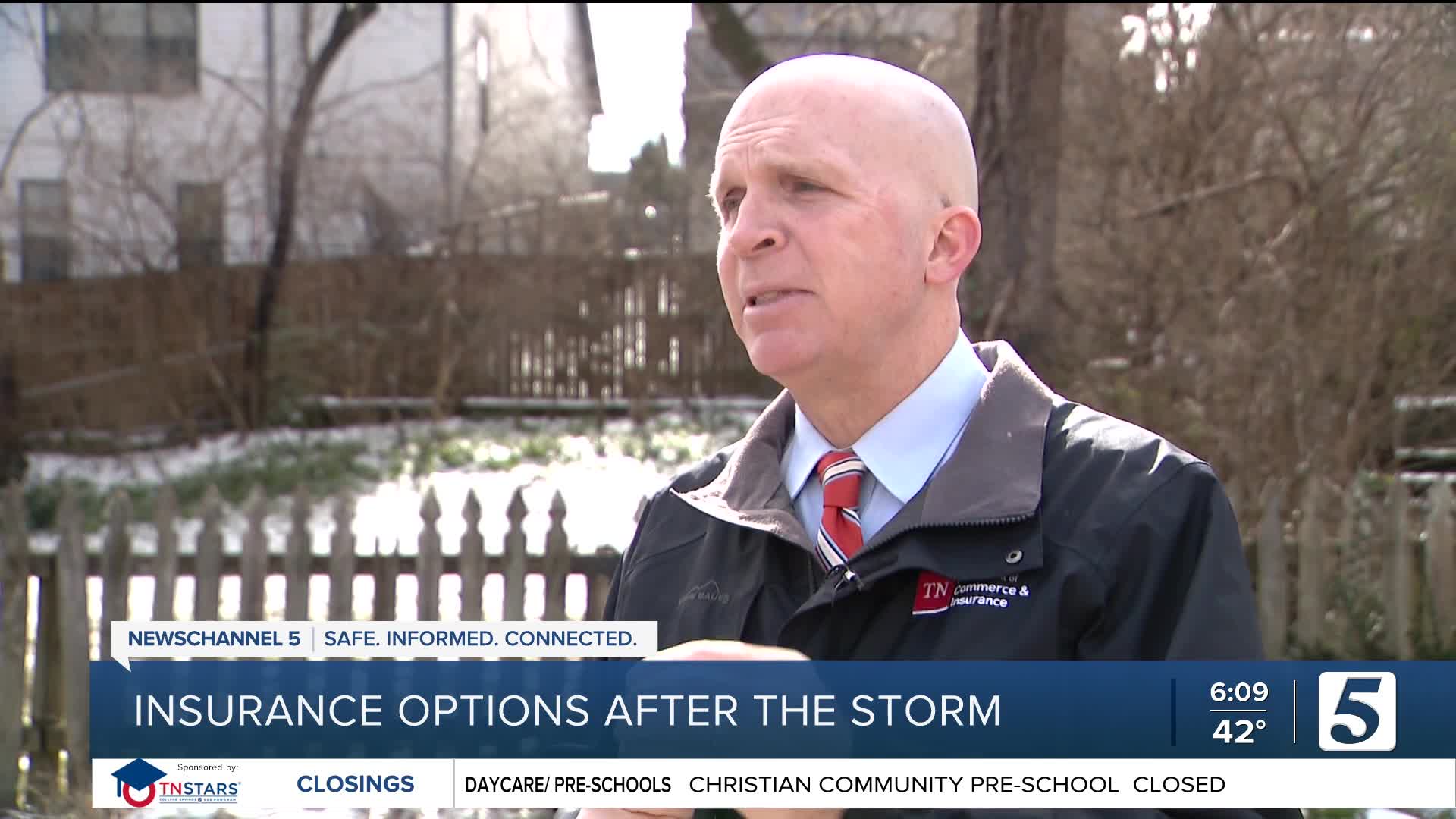

"If a tree falls on your house and it's because of ice, most policies will cover that," said Kevin Walters, Tennessee Department of Commerce and Insurance.

However, some exclusions might surprise you. If your insurance company decides you didn't take reasonable steps to prevent frozen pipes, you could be responsible for those damages.

"You have to take reasonable steps ahead of time to be able to make a claim about what happens in your house while you're gone," Walters explained.

What's likely covered vs. what's not

NewsChannel 5's Sky 5 aerials show the true scale of damage across the region, with numerous homes covered in tarps. Insurance will likely cover structural repairs to homes damaged by falling trees or ice.

However, tree debris in yards and major cleanup messes will probably come straight out of your pocket.

Beware of scammers during cleanup

Although Governor Bill Lee relaxed some licensing rules to speed cleanup efforts, residents should only allow skilled workers on their property and watch for red flags.

"A scammer is going to see you at your low point. You're cold, you're freezing, you want someone to show up and say, I can make it all better for you. And unfortunately, the bad actors are going to be the ones who take your money and leave you holding the bag," Walters warned.

High-pressure sales tactics, unexpected door-to-door visits, and deals offering freebies are warning signs of potential scams.

"Don't make an emotional decision that you're going to be paying for for years later," said Walters.

Resources for denied claims and damage reporting

If your insurance claim gets denied and you believe it's a mistake, the Tennessee Department of Commerce and Insurance can help. Visit their website and click File a Complaint under Consumer Resources.

TEMA is encouraging residents to self-report damage to their homes through an online survey. This helps TEMA track damage and better understand conditions across the state, which can improve chances of FEMA granting individual assistance for households.

Safety reminders for power outages

Power outages are causing some people to take dangerous risks to stay warm. If you're using a generator, place it outdoors at least 15 feet away from any buildings to prevent carbon monoxide poisoning.

Free carbon monoxide detectors and smoke alarms are available through your local fire department or by requesting one from the State Fire Marshal's Office.

This story was reported on-air by Hannah McDonald and has been converted to this platform with the assistance of AI. Our editorial team verifies all reporting on all platforms for fairness and accuracy.

The news surrounding student loan repayment has been ever-changing over the last few years. When it comes to your money, confusion is never a good thing. Thankfully, Robb Coles helps us sort out the path forward. Check out his story for some practical tips and insight behind the latest changes.

- Carrie Sharp